A home loan pre-approval means that you can easily back-up an offer having resource, and this sets you prior to the online game.

For people who complete a bid prior to interviewing all of our financing gurus, a seller you will refuse their offer-although it’s a fair you to-since you do not have a financing alternative in position. And as a result, you could miss out on the best assets.

Should you have so you can thumb using multiple offers and pick anywhere between an excellent pre-approved client and you may a non-pre-acknowledged buyer, which one would you look for? Oftentimes, you’ll squeeze into the buyer having already met with a loan provider.

That said, don’t let your dream family sneak throughout your fingers. Delivering pre-accepted having a mortgage having Blue Spot Lenders is good simple and quick processes. Here’s what we need away from you to begin with.

step 1. Proof of Choose

Be prepared to give a photograph ID, eg a copy of license, passport, military ID, or any other county-acknowledged identity.

After you give us an approval, we’re going to make use of this amount to get your credit history, in addition to demand transcripts of your taxation statements in the Internal revenue service.

dos. Evidence of money

Your earnings performs a primary role throughout the pre-recognition process because it’s accustomed estimate simply how much you may be able to use.

You are able to condition your income towards financial application, however, we must confirm that their monthly money is basically enough to support a mortgage fee. Therefore, we’ll need complete duplicates of taxation statements on previous 24 months, along with permission to verify your earnings for the Internal revenue service.

step three. Evidence of property

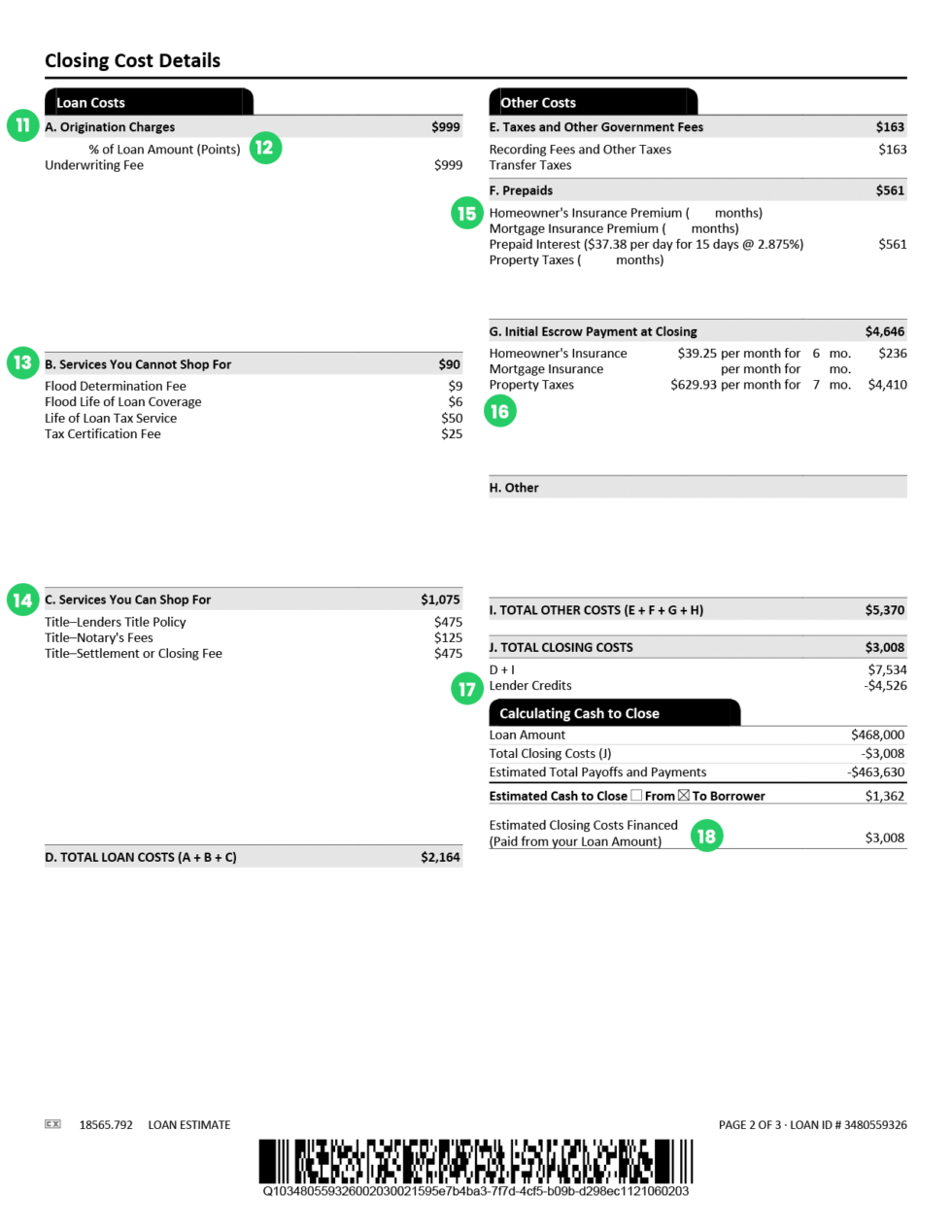

Also recording which you have adequate income to cope with their mortgage repayment, be sure sufficient bucks otherwise property to pay for mortgage-associated costs. Including their deposit and settlement costs.

Their home loan program decides the level of their advance payment. Some programs want as little as step 3% off, or you might require ranging from 5% and you may 10% off. We want the main cause ones fund, very anticipate to fill out statements for your bank accounts and almost every other assets (advancing years, investments, life insurance, etc.).

Without having adequate during the supplies, we shall need a reason regarding how you are able to protection these expenses. And if you are having fun with provide money from a relative, you’ll have to deliver the term of your donor in addition to quantity of the fresh gift. New donor must also fill in a composed declaration confirming one to financing is actually a gift, and never a loan.

cuatro. Appropriate credit rating

There is no need a high credit rating to get home financing, your credit history must be satisfactory to generally meet the fresh new minimal significance of your specific mortgage program.

Typically, you merely you desire a credit score regarding 620 for a normal financing, and a credit history out of 580 having an enthusiastic FHA loan*.

As soon as we pull your credit score, we’re going to besides look at your credit history, in addition to your own present borrowing from the bank pastime. A current reputation for later repayments, judgments, and you may choices could threaten your chances of delivering home financing. Therefore it is crucial that you cleanup the credit ahead. This includes investing expenses on time, disputing mistakes on your credit history, and paying off specific range profile and you may judgments.

A high rating can result in an easier the best personal loans in Kingston pre-approval procedure, which help you qualify for an educated current mortgage costs into the a thirty-12 months repaired home loan or other unit.

5. Work verification

In the event your own tax get back brings details about your revenue, we have to confirm that you may be currently operating which your income has never changed notably while the processing your fees.

When you find yourself a worker, possible complete the most recent paystubs and you may an employment confirmation page. And here your boss confirms their a job condition into providers along with your newest income.

You might be happy to find home financing and you can the audience is excited and also make your ideal be realized. To begin with your house control trip or perhaps to learn about most recent re-finance prices, contact the loan experts in the Blue Place Lenders now. Telephone call (800) 976-5608 otherwise fill out the fresh new contact form.