Steven Hatzakis, an industry veteran with decades of experience in the forex market, leads the BrokerNotes research team. All BrokerNotes content is researched, fact-checked, and edited by the research team. For example, clients of IG South Africa must deposit at least 4,000 South African rand (ZAR), whereas at IG Japan the minimum is 35,000 Japanese yen (JPY). With IG Australia the smallest deposit for a live account is 450 Australian dollars (AUD); in Singapore, it’s 400 Singapore dollars (SGD). The only drawback is the lack of predefined watchlists or screeners, which makes it more difficult to sift through IG’s massive product list.

Does IBKR have fees?

Aside from this Interactive Brokers review, we’ve also reviewed the Interactive Advisors’ robo-advisor service. Customer service is available via chat, phone, and contact form from Sunday afternoon through Friday evening, New York time. IG also won our award for #1 Mobile App (IG Trading), #1 Web Platform, and #1 Forex Options. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. ➡️Cryptocurrencies – While the selection is limited, they offer trading in Bitcoin, Ethereum, Litecoin, and Bitcoin Funds.

- FATF is an intergovernmental organization seeking to combat money laundering and terrorism financing.

- The advantage of a propriety platform is that features unique to that FX broker can be integrated into the software.

- However, there are a few things that prevented Interactive Brokers from earning the highest possible score for its trading platform, such as the lack of IPO access and the lack of OTC access for IBKR Lite.

- The range of markets available to you may vary depending on which of IG’s regulatory entities holds your account.

- IG is publicly traded and holds numerous regulatory licenses across the globe, as well as a banking license in Switzerland.

- While Interactive Brokers does not provide traditional banking services, it does offer its version of a cash management account with a debit card, bill pay, and the ability to earn interest on uninvested cash.

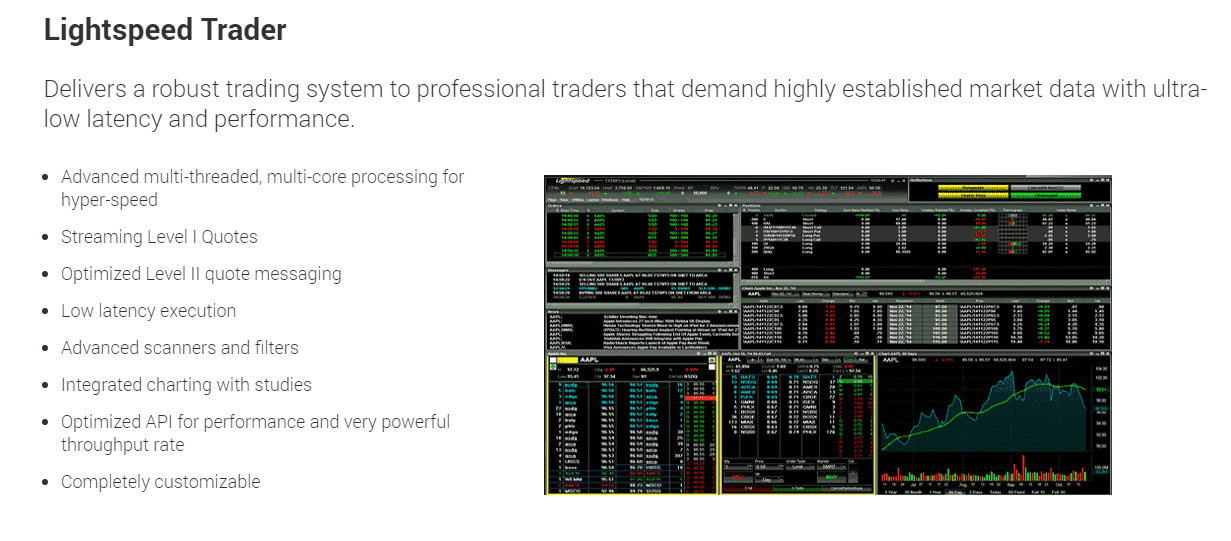

Other Trading Platforms

IBKR has many beginner-friendly features, such as fractional shares, paper trading, and simplified mobile apps. The broker’s investor education covers a broad range of topics and lets you test your newly acquired knowledge through quizzes. Other brokers might come across as friendlier, but IBKR delivers on substance. Money held in an investment account with Interactive Brokers in the U.S. is protected by SIPC insurance, which covers up to $500,000 in securities and up to $250,000 in cash.

Why is it important to know where your broker subsidiary (entity) is regulated?

Order types available on IBKR platforms have some variation between the different platforms. IBKR has a very full array of order types but does not make them all available on the IBKR Desktop and IBKR Global Trader platforms to keep that platform simpler to use. This is done by design so that the more basic platforms do not overwhelm the user, who can always choose to step up their platform to TWS or IBKR Mobile if they want the additional functionality. Interactive Brokers, founded by Thomas Petterffy, has been in existence since 1978, which is approximately 45 years ago. While its headquarters is in the United States in Greenwich, Connecticut, the broker has other offices in four cities. I really like their customer service, very responsive and helpful when figuring out coverage and questions about my account.

Interactive Brokers Commissions and Fees

IG’s innovative “Recommended News” section personalizes your content, aiming to tailor headlines based on your account traits. The additional DailyFX content practically interactive brokers forex review doubles the already impressive amount of research provided by IG. Interactive Brokers offers extensive educational resources to help people start investing.

CMC Market’s Next Generation platform comes with a massive selection of nearly 10,000 tradeable instruments. It delivers a terrific user experience, as well as advanced tools, comprehensive market research, and an excellent mobile app. Hands down, the CMC Markets Next Generation trading platform is a market leader that will impress even the pickiest https://forexbroker-listing.com/ of traders. The new Dynamic Trading tool allows you to place multiple trades simultaneously, which was a nice innovation by CMC Markets this year. IC Markets is the largest forex broker by trading volume, with over $774 billion in forex trading volume in the third quarter of 2021 alone, according to data compiled by Finance Magnates.

Comparing Forex Brokers

There are also 30 technical indicators and 23 analytics objects to assist in analysing the market. The City Index product portfolio is very strong overall includes 21 indices, 4500+ shares CFD, 25+ hard and soft commodities and less common options such as bonds, interest rates and options and one of its major strengths; cryptocurrencies. City Index offers 6 of the most popular cryptos including Bitcoin, Ripple, Ethereum and Litecoin but where it shines is the low costs with some of the lowest spreads and swap rates on the market.

The average spreads of the top brokers shown below are taken straight from the broker’s websites and updated monthly. Moneta Markets is a new brand under parent company Vantage Group, which offers traders the MetaTrader suite of platforms as well as a basic web and mobile app. For traders who appreciate advanced trading tools and quality market research, FXCM is a winner, especially for algorithmic trading. Vantage rounds out its MetaTrader platform suite offering with support for multiple social trading platforms, content powered by Trading Central. The brokerage firm provides direct market access, which means that your trades are executed at the best available prices in the market.

Options and futures fees are organized per contract, providing transparency for traders to reduce overall costs. Overall the APIs cater to various developers and traders, offering solutions for Excel automation and high-frequency trading. Therefore, the IBKR Client Portal is a user-friendly web-based tool for traders and investors, allowing easy account management, portfolio monitoring, and transactions.

It’s possible to build an incredibly diverse portfolio with IBKR with just a few clicks with access to over 150 markets and a wide range of securities. Traders can choose between a more comprehensive Pro account or an affordable Lite account to match their trading skill level and desired toolset. Interactive Brokers offers a number of screeners and tools traders can use to find better investments for their portfolios. It is a publicly-traded company listed on the Nasdaq with a market cap of 33.49B at this time. As a publicly traded company, Interactive Brokers must disclose financial reports, allowing for greater insight into the company’s stability. We used a live Standard Account, probing the Trader WorkStation platform, opened with the Interactive Brokers (U.K.) Limited entity for this review.